Maryland Bankruptcy Exemptions

When people file bankruptcy they are sometimes concerned that they will not be able to keep any assets after they file, think of the old cartoon with a man wearing just a barrel. This is not the case. The law does not expect people to have nothing after they file. Rather, there are certain assets that one is allowed to keep, or exempt from execution or attachment by the trustee, after the case is filed. The amount and type of property someone is allowed to retain varies from state to state.

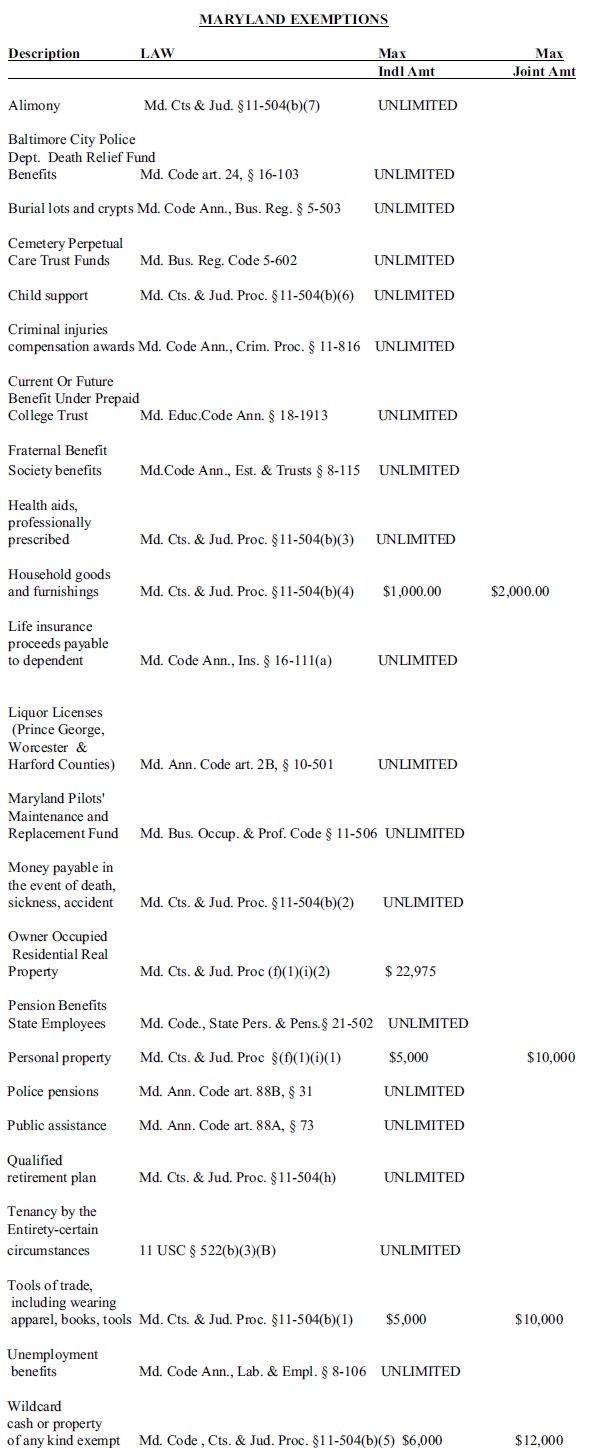

In Maryland, the list of assets one can retain is found mostly in the Maryland Code, Courts and Judicial Proceeding Section 11-504. This section indicates, for example, that an individual can retain $1,000 worth of household goods and furnishings, the amount increases to $2,000 for a married couple. Another $6,000 worth of personal property can be exempt, and the amount increases to $12,000 for a married couple. A newer Maryland exemption involves the equity in one’s residence. The law now allows debtors to claim $22,975 of equity in their house as exempt. At the end of this article is a list of Maryland Exemptions.

Under § 522(b)(3)(A) of the Bankruptcy Code, in order to claim Maryland exemptions, the debtor must have resided in the state for the last two years. If the debtor has not lived here for the last two years, then was the debtor domiciled in Maryland in the 180-day period which immediately preceded the 730 days (two years) prior to the filing of the case? If Yes, then Maryland’s exemptions apply. If the answer is no, then the question becomes which state was the debtor domiciled for the longest period of time in the 180-day period which immediately preceded the 730 days prior to the filing of the case? If there is one state that the debtor spent the longest period of time, then that state’s exemption will apply. If there is no single state that applies, then the debtor may elect the federal exemptions under 11 U.S.C. §522(b).

In order to keep any assets, one must complete Schedule C of the Bankruptcy Schedules and list each asset the debtor is exempting along with the law that will allow that exemption. If the debtor exceeds the limit the trustee appointed to administer the case may file an objection to the exemption. In addition, if the debtor’s assets exceed the exemption, the trustee may require the debtor to turn over the unexempt assets for the benefit of the estate. The trustee may then sell the assets and use the proceeds to pay the debtor’s creditors.